Harnessing the Power of Aoomaal: 3 Strategies for Sustainable Wealth Creation

What is Aoomaal?

The term Aoomaal stems from Arabic and implies having wealth, assets, and worldly possessions. Aoomaal in finance encompasses a diverse spectrum of options, from saving and investment, inter alia, to materialistic assets like vehicles, houses, and precious items. It is the starting point for personal and family financial stability and security, an instrument for meeting day-to-day needs, a tool to tackle emergencies when they arise, and a mechanism for building financial future aspirations.

Good management of Aoomaal is critical to realizing the organization’s long-term financial goals and objectives. This entails sound judgment in financial planning between building a financial reserve, investing, and managing risk. Through the development of a budget, people will be able to see how much they earn and how much they spend to identify areas where they can save money, as well as spend their financial resources appropriately. Utilizing saving tactics, such as saving a certain amount of money every month and scheduling the automatic transfer of the money, will help build a protective shield against future needs and dreams.

The other management function that Aoomaal holds in high regard is investment planning, whereby individuals build their wealth over a constant period of time. Designing a holistic investment plan that focuses on your financial goals, risk tolerance, and time horizon is a cornerstone of financial planning, ensuring maximum returns and minimal risk. Developing an investment portfolio that holds various asset classes, for instance, stocks, bonds, real estate, and alternative funds, helps to spread risk and enhance returns.

Moreover, knowledge of how to hedge risks should be considered at the very top of asset protection management. Risk management can be balanced by combining risk management strategies and utilizing investment strategies that prioritize capital protection and growth to ride through unstable market environments and attain sustainable financial growth.

Fundamentally, Aoomaal refers to the expressed wealth an individual or group possesses in terms of both financial resources and assets, which are employed as the stepping stones to achieve financial stability, prosperity, and long-term wealth accumulation. Effective regulatory and strategic utilization of Aoomaal serves as a tool to fulfill financial goals and build a brighter future.

Learning the Importance of Aoomaal in Finance

1. Financial Stability:

Aoomaal is the foundation for gaining financial stability and acts as support during unforeseen emergencies, helping meet daily needs without income dependency.

2. Wealth Accumulation:

Through Aoomaal management, people can generate wealth. Through the proper allocation of resources and getting the highest investment returns, one can build a strong financial base for themselves as well as for future generations.

3. Investment Opportunities:

Aoomaal opens investment opportunities in various vectors like stocks, bonds, real estate, and entrepreneurship. By diversifying investments, the risk is reduced, and possibly higher returns are gained.

Effective Aoomaal Management Practices

1. Budgeting:

Developing a budget provides a basis for successful Aoomaal administration. Tracking income and expenses helps individuals find areas where they can save money and prioritize their resources appropriately.

2. Saving Strategies:

Utilizing saving approaches such as setting amounts to savings accounts or saving a certain percentage of income each month helps in financial cushioning for future needs.

3. Investment Planning:

Creating a customized investment plan based on financial goals, risk tolerance, and time horizon is important for ensuring the long-term solid growth of Aoomaal. Seeking professional advice offers a unique opportunity to gain valuable insights into the world of financial markets.

The Most Common Errors with Aoomaal

1. Overspending:

Spending unwisely and overspending without balancing your budget can lead you to exhaust your Aoomaal, which might prevent you from fulfilling your long-term financial goals.

2. Neglecting Savings:

Not paying attention to savings can make individuals susceptible to financial challenges and reduce their chances of achieving milestones like owning a house or retirement.

3. Ignoring Investments:

The inability to invest in Aoomaal or lack of diversification may become growth constraints and put individuals in risky conditions.

Strategies for Growing Aoomaal

1. Diversification:

In diversity, you’re putting your money in different types of assets and industries. This is a great advantage since if one investment underperforms, the others may still be doing great, which will bring you better returns in the end despite one of your investments underperforming. As a case in point, you could invest some money in technology and healthcare sector stocks, as well as in bonds or real estate. This way, you don’t put all your eggs in one basket, meaning that you reduce the chance of recording big losses even if one asset class or sector experiences a crash.

2. Compounding:

Compounding is like magic, with the rewards of growing your money over time. You can do this by reinvesting the earnings and dividends you make from your investments. And the earnings and dividends that you receive also start earning their returns. Over time, it can be a snowball and exponential expansion of your Aoomaal.

For example, you invest $1,000 and return 10% profit, giving you a net worth of $1,100. If you invest $100 in profit gained this year and earn 10% the next year, you will earn $110 under the profit plus $11 of additional profit on the reinvested amount, which makes your total investment $1,221. Over many years, compounding can add significance to the final value of your investments and help you reach your financial goals sooner.

3. Risk Management:

Investing always comes with some risk; however, managing and understanding those risks is very important to your long-term financial health and well-being. Through diversification of the investments, you spread your risk among different assets and sectors, thereby reducing the impact of poor performance on any one investment. Furthermore, risk management requires an evaluation of your risk tolerance (i.e., how much volatility you are comfortable with) and the adjustment of your assets or investments based on this level of risk.

Likewise, if you are close to retirement and need to hold on to your Aoomaal, you may opt for relatively safer investments with low risk. Systematic review and rebalancing of a portfolio is one of the measures of ensuring that your investments are aligned with your financial objectives and risk tolerance, thus ensuring your Aoomaal is protected from losses and yet still on a growth path.

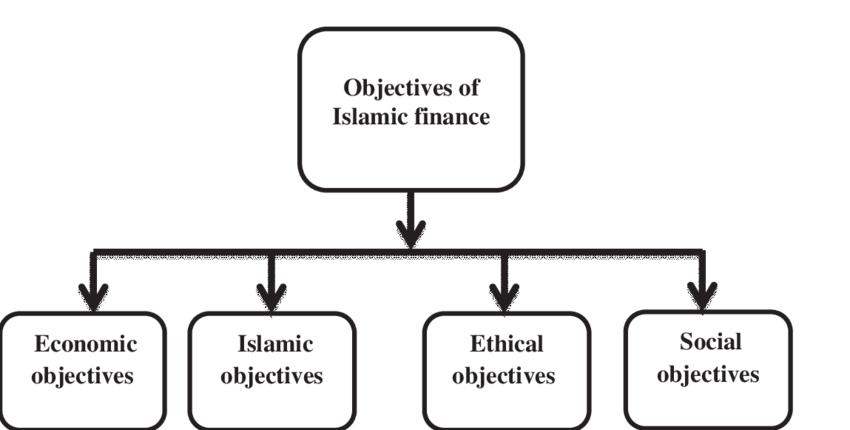

The Place of Aoomaal in Islamic Finance

To be Islamic, financing has to be in full compliance with Sharia principles, particularly concerning Aoomaal, which is wealth and assets. Furthermore, Aoomaal has to be run according to Shariah principles, which include forbidding any activities that are undefined and unethical. Among such activities are alcohol-related businesses, betting, and tarot cards, which are a form of riba.

Sharia-compliant investments aim to offer ethical alternatives for Muslim investors by following Islamic ethical principles. These investments are of more importance to social responsibility and ethics; thus, they make financial operations to comply with Islamic values of fairness, justice, and transparency.

For instance, a Sharia-compliant investor may invest in a company that is not involved in the production or sale of alcohol and prefers medical, technology, or consumer goods companies that comply with Islamic principles. As well, investments in gambling-associated services are avoided, and the funds are rather channeled to the industry that allows social change and economic growth.

As another factor is concerned, Shari’ah-compliant investments do not permit any investment based on interest as it is considered a usury Interest-based business practices are always considered exploitative and unfair. However, Mudarabah, Ijarah, and Murabaha are alternative financing methods facilitated by them and not the conventional means of profit-sharing. These means of financing, thus, create earnings through fair and lawful routes without the need to use unethical transactions as a basis.

However, Aoomaal in Islamic finance does not just impart financial prosperity; it also inspires individuals to have moral behavior and social welfare because the Sharia principles are followed. Muslims will act as active participants in the Islamic finance system, where they will benefit from all opportunities available to them with total assurance that Islamic values will be maintained and the community will be progressive.

In summary, Sharia law-based investments stand out as the groundwork for ethically and morally acceptable financial activities, and this brings them in line with Islamic banking.

Conclusion: Becoming a Culture of Financial Resilience through the AOOMAAL Initiative.

In a nutshell, Aoomaal is a prerequisite for financial health and it is the instrument to implement their vision, acquire precision, acquire wealth, and secure the future. The aim of the company can be achieved with the help of sound management strategies and ethical standards by Aoomaal, which can enable economic hardships for people. Resource use efficiency, which includes savings, investments, and assets, is the basis for owning financial barriers and creating wealth.

Additionally, values that are observed in ethical matters are considered to make financial choices that become ideal and bring benefits to society. Aoomaal can sustain itself in the long run under good management and ethical practices to meet the financial dreams of an individual, the support system and possessiveness in the present as well as in the future.

FAQs:

Q.1: What is the meaning of Aoomaal in individual accounting?

Aoomaal assumes an imperative role in individual accounting by giving the assets important to meeting costs, accomplishing objectives, and creating financial well-being over the long run.

Q.2: How might I deal with my Aoomaal?

Compelling Aoomaal, the board includes planning, saving, effective money management, and chance administration to enhance development potential and shield against monetary vulnerabilities.

Q.3: What are a few normal slip-ups to keep away from with Aoomaal?

Normal errors include overspending, disregarding reserve funds, and overlooking speculation, all of which can block monetary advancement and endanger long-haul objectives.

Q.4: Which job does Aoomaal play in Islamic money?

In Islamic money, Aoo maal should be overseen following Sharia standards, underlining moral contemplations, and precluding association in specific enterprises considered rebellious.

Q.5: How might I become my Aoomaal?

Techniques like enhancement, compounding, and taking a chance with the executives can assist people with becoming their Aoo maal consistently after some time while limiting expected misfortunes.